The financial education have a high social value for societies and people because it makes it easier for us to make informed, judicious decisions and thus ensure that the final choice is surely, the best we do. Financial education must boost during all stages of life, better when children are younger, and of course, you should integrate into educational plans. For that, teachers, educators, parents and the entire environment of influence of the child will have to be aware that children not only learn basic concepts such as bank account, credit card, debt, mortgage, tax, financial instruments, inflation or savings, but they will also have to know how to relate them to the context in which they will need them: home economics, private companies, the public sector, etc.

And for that it seems fundamental that the kids get used to reading and watching news on a daily basis to have opinion and knowledge. On the Internet, it is said, that there is a lot of information at our disposal although there seems to be little knowledge. According PISA, the financial competition is knowledge and understanding of financial concepts and risks and the skills, motivation and confidence to apply such knowledge and understanding. That is why financial education will allow young people to make effective decisions in different contexts.

From the private company They are making movements to make financial education a task for everyone. For example, the president of BBVA, Francisco González, in the presentation of the financial education PISA report, sponsored by the bank and which can be seen below, “people's financial education is a collective task in which financial institutions must also play a fundamental role. Financial education favors the personal financial situation, improves risk management, drives savings and strengthens the financial system. Financial education reverts, in short, to more consistent savers and more responsible debtors. ”

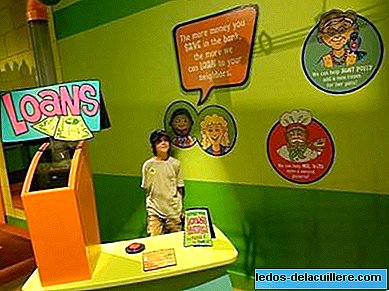

So we have to encourage the introduction of these concepts in the school curriculum since there are increasingly more complex financial products and services and young people will make more sophisticated and complicated financial decisions in the future than their parents.

From the age of fourteen, I believe that teenagers have to master concepts associated with bank accounts, Internet payment services, credits and loans. And also start reading microeconomics books Y macroeconomy with a strong load of dissemination to allow to learn and fix typical concepts.